Is TEMU Legit? Is It The New Amazon Rival?

Many of us are dealing with tough times right now. As inflation is skyrocketing prices on food and household goods, it’s an easy decision to launch a discount marketplace. There might never be another opportunity like now to start.

The most downloaded free app on both the App Store and Google Play for much of last couple months wasn’t TikTok, YouTube, or Instagram, but a shopping app that didn’t exist just a couple months ago.

What is Temu?

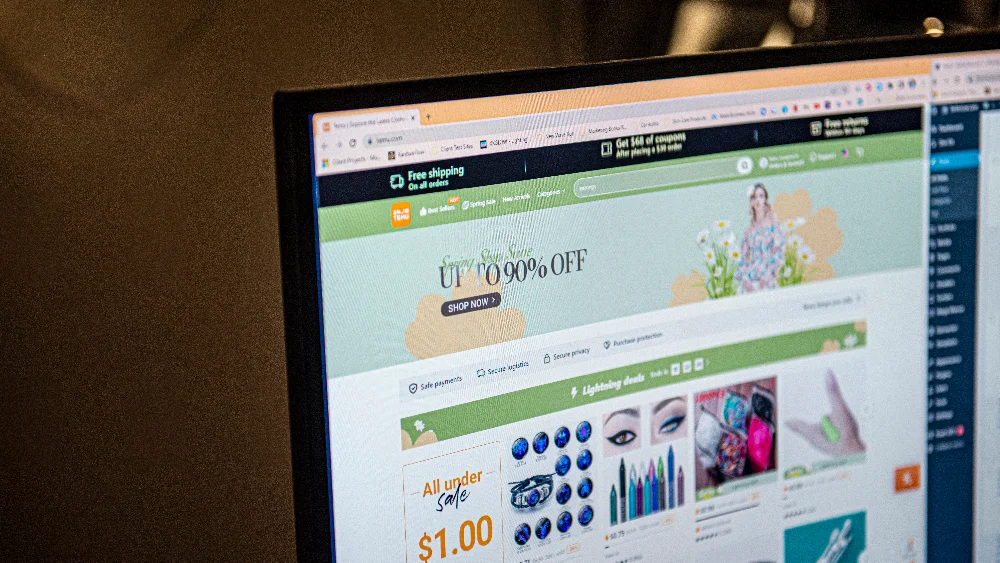

Temu, pronounced “tee-moo,” is a brand-new online shopping platform with severe AliExpress vibes. One could argue their overall web design colors are a shade or two apart. This website is gaining tremendous popularity among Americans, even more so after Temu’s Superbowl ads.

According to their website, Temu was founded in Boston, Massachusetts in 2022 by its parent company PDD Holdings Inc. (Nasdaq: PDD), which also operates Pinduoduo in China.

American Consumerism

Americans are looking for sweet discounts on everyday goods ranging from kitchen appliances, clothing, electronics, and more. Since it’s September launch, the Temu app hit over approximately 11 million installations in the U.S., according to data from analytics firm Sensor Tower.

With costs rising on a regular basis in the U.S., Temu is catching the attention of major retailers in America, especially Amazon.

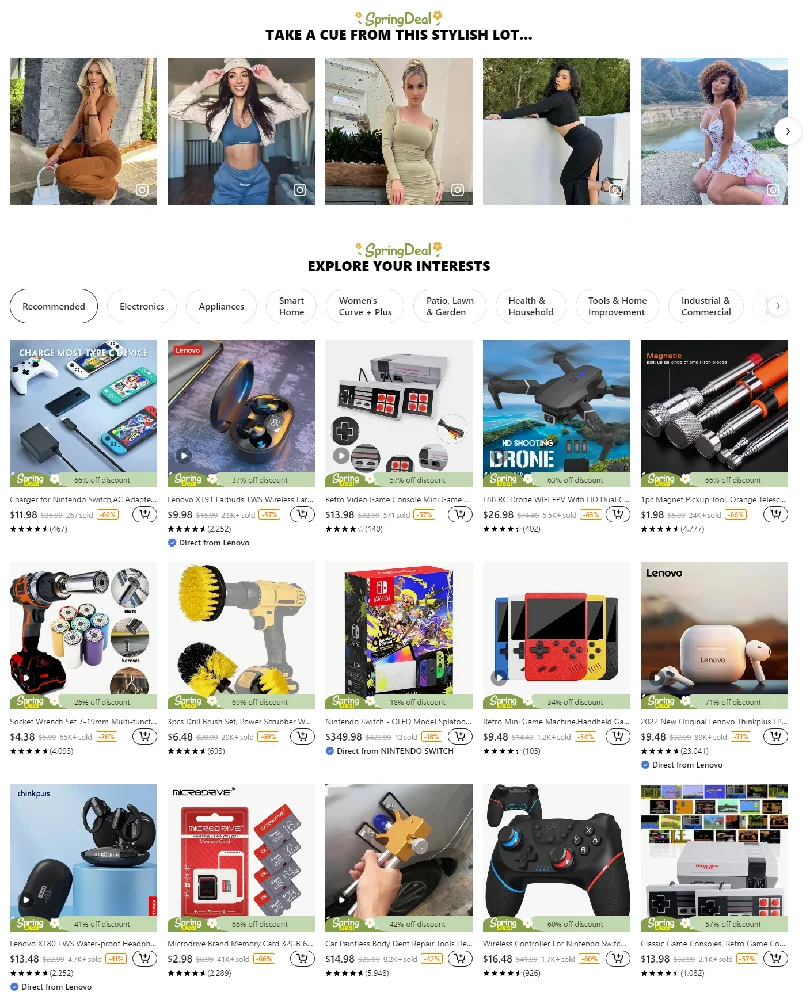

Pricing Strategy

Kathy Benetti, 68, told The Wall Street Journal that when she originally downloaded the app she didn’t expect to order as much as she did. However, she spent $90 on 14 items and was impressed by how much cheaper the prices were than Amazon.

Temu seems to be finding success by selling heavily discounted products straight from manufacturers to American buyers, who have the purchasing power to buy. As of this article release, the company has a market cap of $109 billion. Its stock price increases during a year in which competitors like Alibaba takes severe hits.

It’s clear that Temu is offering sometimes unbeatable low prices by taking advantage of its parent company Pinduoduo’s supply chains. This way they can extend the savings onto the customers.

Low pricing strategy has unfortunately come at a cost for other companies. Shein, a low-priced Chinese fast fashion site, investigates its own factories after a damning report on working conditions. And the results are costing $15 million to fix for violating labor laws. To this point, there are no current signs Temu is offering low prices at the expense of its workers — so only time will tell if the budget marketplace is too good to be true.

Temu vs. Amazon And Everyone Else

Amazon still has something over Temu that is a significant factor in American spending; speed.

According to Temu’s website, orders can take anywhere from 7-15 business days to arrive and they offer additional cred it discounts if it takes longer. This is of course significantly longer than Amazon’s delivery speed of about 3-5 business days. And that’s not considering Amazon Prime perks like two-day and sometimes same-day delivery.

Marketing Strategy

Besides low prices being a huge factor in Temu’s marketing strategy, they utilize traditional and digital advertising campaigns to solidify their user growth.

Many new customers are not spending a single penny. Temu launched a social media campaign in which the more a person convinces others to sign up, the more credit they earn. Many people have enough credit to received good straight to their home, without ever giving Temu credit card information. One can assume Temu is being subsidized to be a loss leader in order to gain market share. This is not different from what Amazon did for a long time.

Temu’s “Shop Like a Billionaire” ad during the 2022 Superbowl capitalizes on the brand message of living the high life on a worry-free budget. The pleasant young woman in the ad even goes as far as to shop for others and “share the wealth” with low prices on clothing and select items.

This is “fun” shopping, with minimal effort, endless choice, and little financial sacrifice. This is a company’s wet dream. It’s difficult to compete in an environment like that. And it is proving to be the ideal way for Gen Z to shop.

Looking back, the ad ties itself to extensive discounts via the app and a prize-giveaway promotion strategy. This is in contrast to more emotionally moving, Superbowl ad strategy. Temu goes for something familiar, rather than remarkable. After all, cycling through more and more cheap stuff that isn’t built to last is already a popular pastime. Americans reportedly buying five times more clothing than they did a few decades ago.

Temu seems to be just advertising, and selling, mindless consumption itself. What’s more American than that?